Every three months, companies all across the world release information on their financial performance and situation to the public as part of regulation and to keep their investors informed. In the video game world, the situation is no different, with many big names such as Nintendo, Activision and Square Enix reporting their earnings in early February. Often this is translated poorly in the media as journalists have typically focused on eye-popping statistics such as a “77% profit drop” or on curiosities such as Nintendo President Satoru Iwata last year in an investors Q&A referring to the Apple iPad as a bigger iPod Touch. Unfortunately, such reporting does little to describe the actual state of the industry.

To start, the first question that should be answered is, how should the financial performance of a company be evaluated? There are two benchmarks that immediately come to mind: the sales (“top-line”) or profit (“bottom-line”). In lemonade stand economics, sales (also known as “revenue”) are the number of units sold times the price at which they are sold or in other words, how much total money the firm brings in from selling their goods or services. After this, the firm pays out expenses which are usually categorized in one of two forms: operating or other. Operating expenses are expenses directly related to the business such as the cost of producing the hardware or paying the salaries of employees. Sales minus operating expenses are referred to as operating income (also known as “operating earnings” or “EBIT/EBITDA”).

Operating income is a good measure of how much profit a company makes from conducting its regular course of business. Beyond operating expenses, a company can incur other types of expenses such as paying interest on debt that it has borrowed to help grow the business. Embedded into both of these types of expenses are irregular, non-recurring items such as one-time charges for mergers and acquisitions related charges or changes in foreign exchange rates. Because of this, the profit (also known as net income or earnings) which are sales minus total expenses tends to fluctuate heavily from quarter to quarter. Hence, changes in profit over time can be enormous, resulting in the large figures cited in news media headlines.

To avoid this, many research analysts dig deep into financial statements and company filings to remove irregular operating expenses and determine a recurring operating income figure. However, when applying this to video game companies, it can be difficult to do for companies such as Microsoft and Sony. For these companies, video games only account for around 10% of their total sales, so disclosure on what financial items are used to determine operating income is not always known. Hence, to understand the performance of video game companies at a point in time, sales are a good starting point. The advantage is that information on sales is more readily available and that sales are less prone to fluctuations when compared to profit. The disadvantage is that in the video game industry, especially on the hardware side, a company can boost sales through price cuts but lose considerable money in profits with every sale.

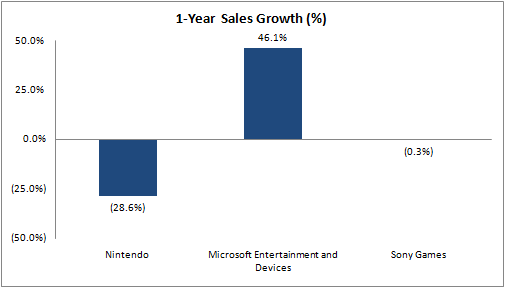

Keeping these points in mind, the following figure represents the represent the change in sales in video games from 2009 to 2010 for three console manufacturers. One important note is that the Microsoft Entertainment and Device division includes sales from several other products including the Zune, Windows Phone and software sold on Macs.

As the figure might suggest, 2010 was a strong year in sales for Microsoft while Sony and especially Nintendo suffered. One important factor is that for all three companies, around 40% of their annual sales are made in the three months between October and December. This was an especially strong period for Microsoft with the launch of Kinect and the increase in sales in Xbox 360s following the July redesign and release of Halo: Reach. Microsoft’s calendar fourth quarter sales were up 55% while Nintendo’s fell 30%. This was indicative of a trend as Nintendo’s sales fell every quarter year-over-year in 2010 while Microsoft’s division saw increases every quarter. Sony was a mixed bag showing strong 15-30% increases in the first two calendar quarters and 10-15% declines in the final two.

From a profit standpoint, both Microsoft and Nintendo make around 20 cents of operating profit for every dollar of sales, so it doesn’t appear that Microsoft took a significant hit on their bottom line to get market share (although it should be noted that for accounting purposes, not all operating expenses such as capital expenditures to fund new projects are included in determining operating profit). Sony doesn’t disclose operating profit for its game division.

The lesson to be learned from the above figure is that the video game industry can’t be judged only by a point of time. Like the movie industry, the video games industry is a hit-based business. 2010, especially in the fourth calendar quarter, happened to be a hit year for Microsoft. Take Two Interactive, the parent company of Rockstar Games, had often been criticized for only being profitable in years in which Grand Theft Auto was released. A more accurate picture of how a company has performed in recent years might be the total profit or sales generated over a longer period of time such as three years.

In investing, many investors value companies based on the amount of profit that the company is expected to make in the upcoming year. For video games, research analysts and investors have found more appropriate metrics such as looking at three years of expected profits. This accounts for the fact that the video game companies have many unprofitable years and that the industry is so hit-based. If you were looking to invest in Rockstar Games and Grand Theft Auto V is not expected to come out until 2012, would you only look at expected profit in 2011? The answer is, of course not.

That being said, the information is not entirely meaningless. Nintendo President Satoru Iwata might be curious as to why Nintendo had such a poor year in 2010 when compared to 2009 even though they released Super Mario Galaxy 2, Kirby’s Epic Yarn and Donkey Kong Country Returns. Iwata might completely forget about 2010 if the 3DS sells like gangbusters in 2011. Earnings season is a time in which financial statistics and jargon are thrown about and companies’ profits appear to going up and down wildly. It serves its purpose by letting the managers of companies know how its business has performed at a point of time, but it can be entirely misleading of how it might perform in the near future.

This might be off putting to investors who would prefer to invest in companies with more predictable and regular profits. But this constant state of change is what makes the industry great: it’s an industry in which in just a few short years a company such as Electronic Arts can go from being an acquisition addict to becoming committed to developing a few high-quality games; a little known producer of Tony Hawk games such as Activision can become an industry titan; and in which a company such as Nintendo can have its existence questioned in 2003 only to be re-recognized as the master of the art only a few years later.

ShareThis

ShareThis